Oddz Finance - A New Standard For DeFi Options

Blockchain-agnostic, trustless on-chain option trading platform on Binance Smart Chain, Ethereum and Polkadot.

Subscribe to our newsletter to keep up with our research and join our community of skilled investors on Telegram.

The past year or so has seen not only a surge of innovation in the Decentralized Finance (DeFi) space, but also has provided an ever evolving definition of the field itself. Trailblazing projects like Compound Finance introduced the masses to the concept of financial self sovereignty, which some would argue is the cornerstone of DeFi, but Compound certainly wasn't the first. Ironically, much of today’s key infrastructure in lending/borrowing, liquidity pooling, data provision and other key elements of DeFi were launched as early as 2017 (or 2015 if you count the launch of Ethereum).

This begs the question, that if the infrastructure was around in the bull market of 2017, why did it take until 2020 for the field to explode? The answer is possibly a combination of market cycles, immaturity of the field and the lacking user experience that was enhanced by platforms like Uniswap. Now we’re in the midst of a raging bull market, the once insurmountable task of picking a winner in the bear market, suddenly seems quite easy. Again, just like in 2017, we’re seeing the creation of blockchain-based analogues of traditional finance services. The concept of DeFi makes this pattern even clearer, with there now being a number of “decentralized” versions of just about every traditional financial mechanism you can think of.

Before we discuss one of the next fields the DeFi juggernaut is set to conquer, it’s important to mention a key driver of investing and trading habits we’ve witnessed - financial stimulus! A combination of what many deemed an inevitable economic recession and the Covid-19 pandemic, put governments in a position where they had to take measures to prop up their economies. In America, the chosen solution was to print trillions of dollars, and use them to directly purchase shares in the open market. This has been coupled with multiple stimulus payments to US Citizens. The resulting rapid devaluation of the dollar, stock market surge, and the new era of trading platforms catering for small investors led to a wave of high-stakes investing and trading.

The army of speculators took to the Robinhood trading app, resulting in a 230% increase in transaction volume between 2019 and 2020. With the latest stimulus package underway, a survey from Deutsche Bank revealed that a third of recipients up to age 34 planned to spend part of their stimulus cheque on stocks, which is eye-opening and obviously doesn’t even account for their crypto investments. Now, let’s get to the juicy part - $602B of the volume in traditional markets comes from derivatives and 80% of derivatives traded are options contracts. Indeed, it appears that the market participants of today are normalized to complex contracts and are enjoying high-stakes investing.

A service that caters for this newfound lust for derivatives and specifically options, is a gold mine to be tapped in the DeFi space. However, today we’ll discuss how Oddz Finance are doing one better and bringing ease of use to derivatives trading akin to what Uniswap brought to the decentralized exchange (DEX). Today we’ll introduce to you automated market making (AMM) for options trading.

What Are Options?

Firstly, it’s important to understand what derivatives are. The Oddz Finance whitepaper describes them as follows: “Derivatives in simple terms are financial instruments that derive their value from the underlying assets. The primary utilities of derivatives constitute hedging, speculation and arbitrage. Market places include futures, forwards contracts, option agreements and swaps”. The paper further explains: “The underlying assets can constitute stocks, market indices, bonds, currencies, forex, commodities and interest rates and so on”.

Investopedia describes an option as “a type of derivative security. An option is a derivative because its price is intrinsically linked to the price of something else. If you buy an options contract, it grants you the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.” So with a call option, you’re essentially counting on the price of the underlying asset to rise before the expiration date of the contract and with a put option you’re counting on the decline.

Oddz Finance Platform

Oddz Finance aims to be a blockchain-agnostic, trustless on-chain option trading platform on Binance Smart Chain, Ethereum and Polkadot. The platform will include a novel automated process that uses liquidity providers for contract underwriting. Users will be able to create custom contracts based on their personal risk tolerance, on a broad range of assets across multiple blockchains.

Traders

The primary goal for the platform is to make options trading simple, straight-forward and auditable. The team plans to look after smaller investors by making fractional options for smaller volumes. Strengthening this, is the fact there will be no gas fee for traders, which will be achieved by the team diverting the gas fee to the protocol via a relayer. There will also be an option to create custom contracts with a transparent (on-chain) premium calculation. Below shows the data fields the user would enter in order to generate a contract:

Type of option (call or put)

Type of asset (eg. ETH, DOT)

Strike price

Expiry date

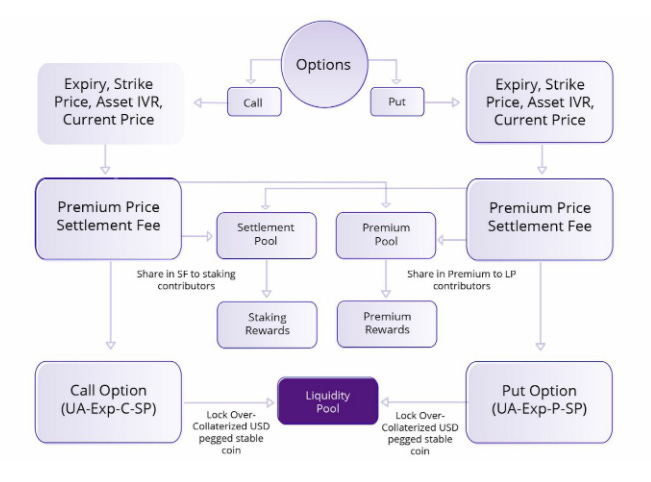

From there the liquidity providers are used to calculate the premium based on the industry standard Black Scholes Model. External inputs required like Implied Volatility and current asset price pulled in via on-chain oracles

Liquidity Providers and Stakers

Critical to the process, the liquidity providers are the contract underwriters for the options contract. As such, there needs to be strong incentivization for them to participate by staking their capital. Liquidity providers put up stable coins as collateral and are rewarded with their fair share of fees collected from premiums and also contract settlement fees. Creating stable liquidity is key, so liquidity providers are incentivized to provide liquidity for a minimum of 14 days in order to receive their full share of the premium.

dApp Developers

While information surrounding this topic is limited, the team plans to enable developers to build dApps that interface with the Oddz Finance protocol. A proposed custom in-house oracle service is meant to render this a possibility. The whitepaper suggests that the oracle and the blockchain-agnostic protocol utilizing Binance Smart Chain and Polkadot will be required first.

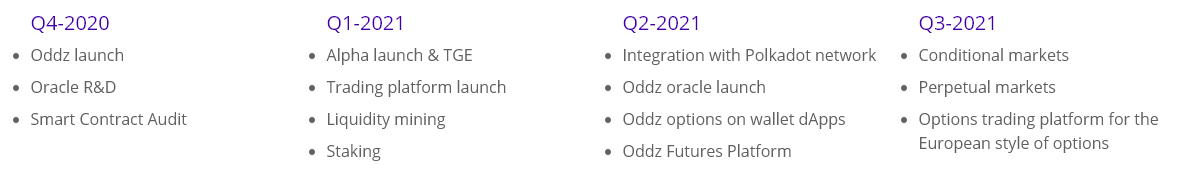

Roadmap

Step one for building the exciting products in the pipeline is perfecting the options trading protocol for American style options. As part of this process, the team aims to build their own price oracle, suggesting it will provide more reliable data, tighter security as well as fast and cheap transactions. Other forms of derivatives will then be tackled beyond call and put options, such as a conditional market, swap contracts and leverage tokens.

Conditional markets, or prediction markets, allow a user to enter a contact based on a finite outcome of a particular event happening within a certain time frame.

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. This is a broad and complex undertaking, so this roadmap item is to be taken with a grain of salt at this point in time.

Leverage tokens, for example the ETHUP and ETHDOWN contracts on FTX, are tokens that represent a leveraged trade but without the complexities of margin, liquidation or funding rates.

ODDZ Token

The $ODDZ token is the native utility token representing the Oddz Protocol and its ecosystem. The token is the central point of the incentivization structure on the Oddz Protocol and its governance models. It has the following use cases:

Trade options and pay for protocol transaction fees

Staking

User-centric governance

Reward mechanisms

Referral bonuses

The platform users will actively participate in major protocol proposals and upgrades, thus driving decentralized governance on the Oddz platform. The users can maximize returns by participating in staking mechanisms and employing high yield farming strategies.

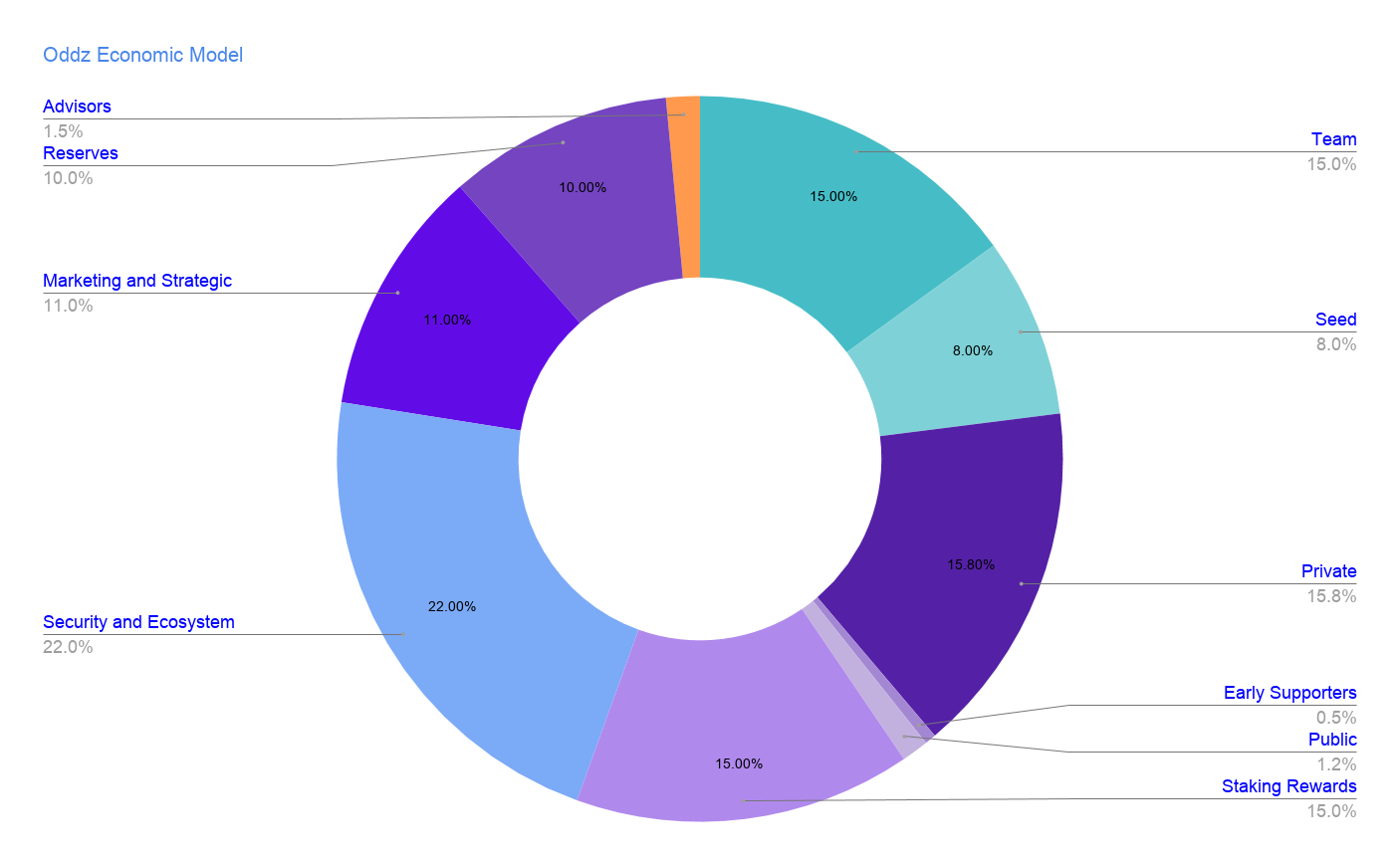

Token Metrics

Oddz Finance is just hours away from their IDO on Polkastarter followed by the token generation event. Visit their announcements channel for details.

Oddz Finance are evaluating the project at $1.5M at the public stage, significantly lower than previous derivatives platforms but fair given there is currently no MVP. This gives speculators a fair opportunity to get their stake in a potential gem.

The supply release at the token generation event is 9.22%, which is far better than some low-floats that have hit the market with as low at 1% of the total supply, leading to large inflation over time. Early investors have a fair vesting schedule that controls sell volume but also incentivizes them to promote the projects through their networks.

The team is subject to a fairly standard 6 month cliff, which should give adequate time to release the first version of the platform. The remainder of the economic model is fairly allocated with confidence-inspiring cliff and vesting schedules.

Closing Thoughts

In this market, timing is critical to the popularity of projects, regardless of how ground-breaking and complete their technology is. We believe that the time is now for structured finance products like the range of derivatives that Oddz Finance plan to offer. Just as Uniswap ushered a new era of trading with the invention of the automated market maker, Oddz Finance could capture some serious trading volume with their novel contract creation process and set a new standard in the process.

The information on this website is for general information only. No information provided in this article or any other content created by Coinvision constitutes financial advice. Coinvision is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website.